The Government of Canada announced on September 1, 2023 that G.D.P. growth was -0.2% annualized in the second quarter. This was below what the central bank and economic forecasters had predicted. Most of those predictions were in the 1% to 1.5% range. From experience, I can tell you that is a huge miss. However, it gets worse. If you have been following my work here and in other publications I have pointed out that because cost of living increases are understated by the U.S., Canada and other western nations, GDP growth is lower than reported. In fact, in my opinion, it has been negative. Adding further to the seriousness of our situation, the population growth in Canada has been significantly understated. Apparently, the population of the Once Great White North was not somewhere between 38.5 and 39 million but 40 million. Oops! The -0.2% headline figure for G.D.P. was on total G.D.P. and was not on a per capita basis. Adjusting for a larger denominator (total real G.D.P. divided by population) and the understating of the effect of inflation, real G.D.P. has fallen, on a per capita basis, on a level only seen during serious recessions or even the depressions that preceded the Great Depression. The gaslighting is over. People are not crazy. Canada is getting significantly poorer. Other nations will follow to various degrees.

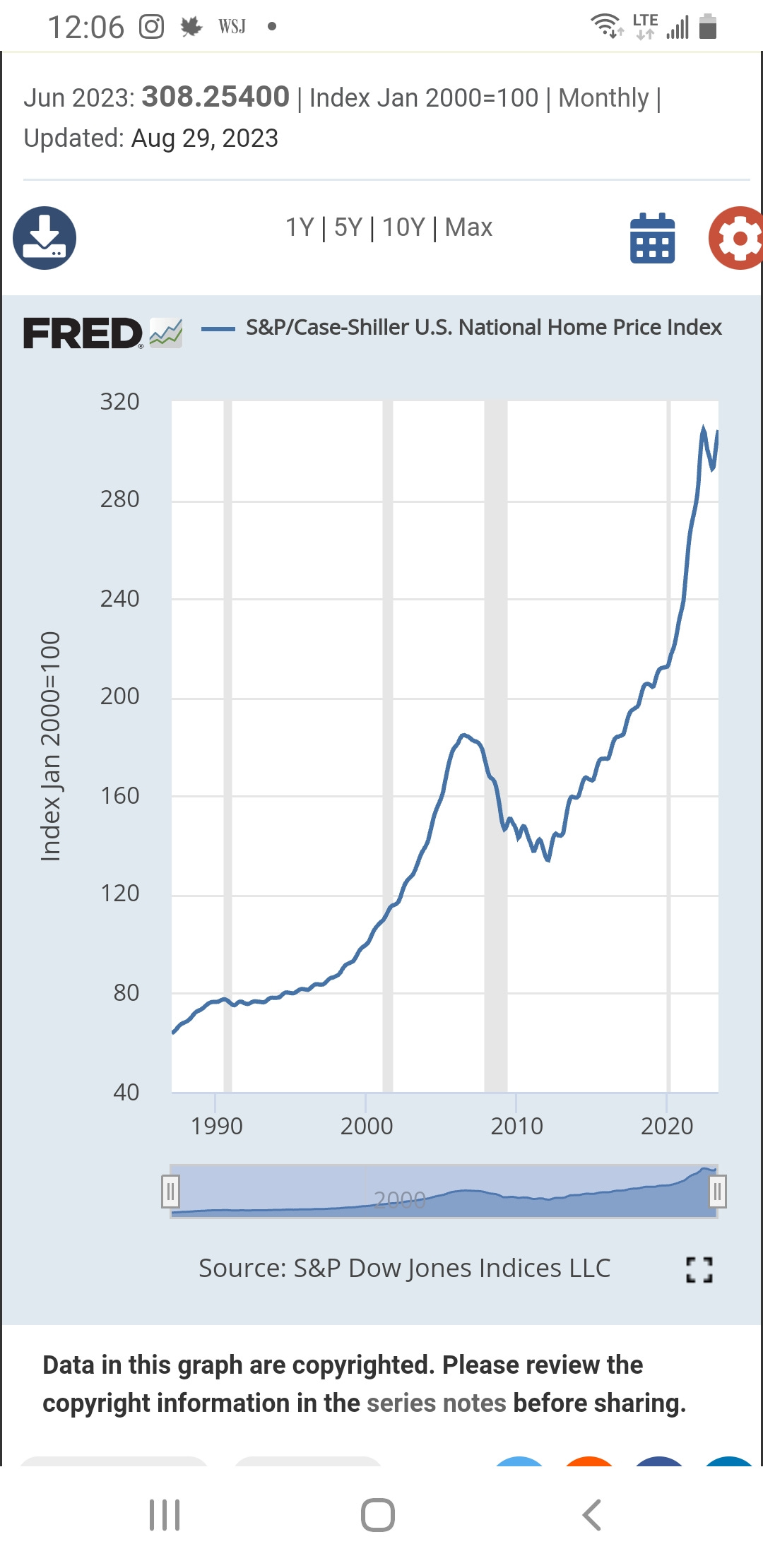

Canada is hardly alone. The U.S. is also entering a serious economic downturn. The housing market is a bubble. Regardless of government and corporate media bullshit, if less people cannot afford housing because the ratio of their income to housing costs decline, they are poorer. True, homeowners have more wealth on paper due to rising house prices but the situation in unsustainable. Also, a house rises in value but remains the same asset. It’s not like a factory that expands and can make more widgets and profit. We looked at the Shiller Home Price Index. It looks like the chart of the Nikkei in 1990 before it entered a two decade bear market. Depending on an individual's current position caution is advised. Now might be a great time to cash out by downsizing, moving to a less overextended market or renting.

Eventually, the chart above will return to the normal growth rate. House prices will decline by one-third to one-half in real terms (adjusting for inflation). Critically, interest rates have shot up. The mortgage costs of a home has exploded even more than the average price chart indicates. Given how much the average Americans net worth is made up of the equity on their home, we are facing the largest loss of wealth in U.S. history. This will caused a collapse in consumer demand and a credit crisis as those holding mortgages as assets will see massive write-offs. Avoid mortgage lenders, banks and mortgage backed securities.

The equity markers are significantly overvalued by historical norms. Our two favorite long term value indicators, the Shiller P/E ratio and Buffett indicator are a levels that preceded major bear markets in the last century such as the Great Depression, Dot Com crash and the Great Financial Crisis. Unlike home prices, stock prices can collapse relatively quickly. We are not necessarily talking about one day crashes like Black Tuesday 1929 or 1987 but a situation where the market falls by over 25% between long weekends. Also, neither the Shiller or Buffett indicators adjust immediately for higher interest rates. The denominator of the Buffett Indicator is G.D.P. The Shiller Indicator is affected by long term earnings which is highly dependent on economic growth. If our view is correct, that future G.D.P. growth will be lower than any time since the 1930's, stock prices have a serious weight on them.

The rest of the world economy is in pretty rough shape as well. Europe is a mess thanks to high inflation, low or negative growth and the effects of the war. China is not bailing us out. Unlike in 2008, the Chinese economy is worse off than most western nations. It’s debt bubble has finally popped and the pain is only beginning. Also, the G.D.P. of China is about 18% of the world economy. In 2007 it was only 6%. Annual growth will not return to previous levels as the Chinese economy is more mature. The lesser developed nations are melting down for the most part. Starvation is increasing for the first time since the 1960’s. The Arab world from Morocco to Iraq is imploding.

People have coped with much tougher times before and they can and will again. However, the whiny, helpless and entitled attitude that our current culture has infected people with over the last few decades will be be problem for those individuals who refuse to grow up and, potentially, a catastrophic problem for the rest of us as there is a significant probably of increased violence and disorder. Protect your assets and eschew flaunting that your doing well. Desperate people do desperate things. This could range from being robbed by strangers to having acquaintances and distant relatives try to mooch off you.

Lowering the stock weighting of your portfolio will lower risk. Long government bonds may not pay as much as shorter bonds but they usually rise in price during stock meltdowns. Unlike 2020, when this strategy did not work, long bond yields are not a four millennial lows. In fact, they are at their three-hundred year average. Resist the temptation to get extra yield from corporate bonds. Spreads between corporates and governments are too low relative to how shaky companies look right now.

Investors might look at a protective put strategy where one buys put options on a small percent of their wealth. One has a high likelihood of losing that money the same way most of us lose money on on travel medical insurance. Those puts will soar if the market falls significantly. However, this is a sophisticated strategy and you will need an ethical financial expert who understands options.

Here is a confession. In my career, much of what made me effective was not making my clients more money than my competitors but letting the markets do their work and minimizing loses when things went south. Things always eventually go south. However, they eventually recover and avoid being a perma-bear. There will be a time in the next few years when it will be time to aggressively buy. That time is not now. It will be when everyone else is despondent.