The focus on tariffs, the U.S. foreign policy pivot away from Europe and Canada towards Russia, and Elon Musk’s evisceration of government workers has distracted most of us from the coming fiscal storm. U.S. debt to G.D.P. is at about 123% and climbing. The deficit to G.D.P. ratio is currently between 6% and 7%, with the potential to go much higher if the economy slows down. This looks more possible each week. The de-globalization of trade which has accelerated with Trump’s tariff policy will make matters worse by decreasing tax revenue as companies reliant on exports lay off workers.

Counterintuitively, companies and workers reliant on imports, in some cases, will also suffer. For instance, California winemakers rightfully worry that the retailers that they rely on to sell their products will go bankrupt due to a lack of supply of European wines and spirits available due to the 200% tariffs proposed by Trump. It also doesn’t help that Canada, which buys over a $1 billion U.S. worth of American wine annually, has removed California products from its shelves. Any increase in tax revenue from tariffs and savings from DOGE will be surpassed by the deleterious effects of Trump’s trade policies. Make no mistake. We need to start labelling tariffs for what they really are: hidden tax increases on the consumers of the nation imposing them. Raising tariffs while cutting income taxes is merely a bait and switch and will put more pressure on America’s fiscal situation.

Some may argue that most industrialized have debt issues. This is partially true but the U.S. is by far, the worlds largest economy and the U.S. dollar is the world’s reserve currency. Greece has a 158% debt to G.D.P. ratio but has an economy less than 1% the size of the U.S. The Greek economy has struggled for generations with high debt and is a serial defaulter. Japan, which also has high debt incurred three decades of little economic growth.

The E.U. for all its economic sclerosis is in a better position fiscally than the U.S. There are various reasons for this. Some larger economies, like Germany enforced some discipline when the E.U. was put together. Also, Europeans may have more generous social programs than the U.S. but they pay for them with taxes. The U.S. tax to G.D.P. ratio is about 25% compared to 40% in the E.U. The debt to G.D.P. ratio of the E.U. is 82%. At 123%, U.S. debt is 50% larger than Europe’s. The E.U.’s current deficit is 3.5% of G.D.P.; not good but better than that of the U.S. at 6.3%. High tax rates have made Europe poorer, but fiscally, they have been more responsible than their American friends.

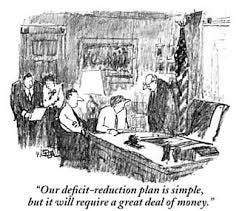

How do we get out of this mess and, perhaps, avoid a catastrophe? Einstein once said: “If I had an hour to solve a problem, I’d spend 55 minutes thinking about the problem and five minutes thinking about the solution.” The debt to G.D.P metric needs to be understood on a more granular level. Both the numerator and denominator are stated in nominal terms for consistency. Debt is simply how much the government owes to debtholders in the future. Debt accumulates because of deficits which are the shortfall of government revenues relative to expenditures. Surpluses happen when revenues exceed expenditures. This situation is rare but has occurred. Consequently, the way to decrease or eliminate the deficit is to raise revenues by increasing tax rates and/or to increase tax revenue. Expenditures cutting is difficult.

As Europe and Canada have painfully learned, increasing tax rates impacts economic growth negatively. Additional tax revenues from raising taxes always disappoints politicians on the downside because economic growth is slowed.

The U.S. has also painfully learned a government may tax cut its way to prosperity but not necessarily have great social programs. The marginal of society will suffer because they rely of those programs. Unfortunately, better social programs incentivize more people to become dependent on hand-outs. Trumpnomics is not a free-market capitalist movement but an attempt to redistribute wealth to MAGA supporters. America has a progressive income tax system. People with higher incomes pay a disproportionate amount of taxes. The top 10% of Americans pay almost 50% of all income taxes. The lower 50% of income earners pay about 12% of all income tax. When ultra-MAGA types on social media rant about their “hard-earned” tax dollars being stolen by immigrants, college professors, Zelenskyy, Canada and everyone else, they are delusional. They absorb more in social programs and other benefits than they pay for. Nations need more productive individuals, not less.

The denominator of the debt to G.D.P. ratio is nominal G.D.P. which is real G.D.P. without the inflation adjustment. Real G.D.P. increases makes debt burden less onerous but it is difficult to increase it significantly on the upside. This leaves inflation. Inflation is a very tempting way to get rid of a debt issue. A government merely pays their debt holders back in a currency whose value they have deflating by printing money. The $1,000 that you put in a ten year bond might only be worth $500 in buying power at maturity. Inflation is government debt welching by stealth.

Canada had a debt crisis in the 1990’s. It was addressed by higher taxes and cutbacks in the growth of government spending. It was successful in getting us out of the crisis but Canadians got poorer relative to the U.S. and most of Europe. The Canadian dollar dropped from $0.84 U.S. to $0.63 U.S. or 25%. Sweden and Finland also experienced painful debt situations in the 1990’s which also included a banking crisis, which Canada mercifully avoided. The point of all this is that when governments allow debt to grow to unsustainable levels there will be hell to pay.

Debt situations are not dire if governments have the will to do the right thing and avoid vote buying at the expense of the future. That is easier said than done but it is easier than most believe. For example, if the U.S. lowers its deficit to 1% of G.D.P., returns to 1990’s levels of inflation, and to growth of 3% and 4%, respectively, the debt to G.D.P. ratio will fall from 123% to 70% in a decade. However, most spending is earmarked for entitlements and the aging of the population continues to put a burden on government finances. In 1970, the median age of an American was 28 years old. Now that metric is 39 years. The percentage of Americans over 65 is now 17.4% versus 9.8% in 1970, an increase of almost 80% as a percent of the population.

The debt reckoning is unsustainable and will be dealt with one way or other. What are the adjustments in investment strategy going forward? Here are a few key points:

Economic growth will be curtailed. Therefore high growth stocks that rely on a growing population and economy are less desirable than in the past. Dividend paying stocks in contrast will be more desirable as present cash flow value has increased relative to potential future profits. Companies that can pass on any potential inflation to customers are in a better position that those that cannot.

Fixed income returns, which have lagged equities will close the gap. When interest rates are higher than inflation, long bonds are justified. Otherwise short bonds that readjust if interest rates increase due to inflation are preferred.

If U.S. economic policy continues without an adjustment, the dollar as a trading currency will decline in importance. The Trump administration wants a lower U.S. dollar. Therefore, the bonds of industrialized nations with less reckless fiscal policies will outperform. Those with more open economies will do better over the long run.

Gold and commodities should, at least, hold their value in an inflationary environment, although gold has already had a good run. Silver is cheap relative to gold. The gold to silver price ratio is near hundred year highs. Selective real estate is appealing since landlords can pass through inflation to tenants. Trust me. I lived through the 1970’s and remember my parents stressing over the annual rent increase on the small rented duplex I grew up in.

Stock to fixed income weights should be decreased. Equity valuations are still near all time highs in the U.S. even after this recent correction. Adjusting for G.D.P., the U.S. market is trading at over three times the valuation of the German market, almost two and a half times the valuation of France, and twice that of the U.K. U.S. stocks are 60% to 70% of total world market capitalization but only 26% of world G.D.P. Equity investors have opportunities outside the U.S.