Many people, from economic “experts” to ordinary folks are talking about the possibility of a recession beginning in 2025. Those on the left are blaming this potential recession on Trump’s economic policies. They understandably are concerned about his erratic tariff obsession. The current administration is only about two months old. Most potential and actual tariffs have yet to be implemented. What makes the assertion that the U.S. is in recession presumptive is that recessions are only known for certain well after they begin, when the statistics become available and are never instantaneously caused by a change in economic policy. The U.S. experienced decent growth in the fourth quarter of 2024. The minor recession of 2000 was not even officially declared until after it was over and it was barely noticeable in the real economy. Facts have failed to prevent media outlets and YouTubers from monetizing fear and anger. Both sides of the political isle are biased to the point that they reject objective reality.

The Trumpian right points out that if a recession does occur, it will be 100% the fault of the Biden administration. They may have the timing correct but they vastly overestimate how much a president affects an economy. In fact, they have also vastly overstated U.S. economic weakness under Biden. Recessions, depending on their exact definition, are like Canadian teams winning the Stanley Cup. There does not seem to be a predictable pattern. In the thirty-eight year period between 1956 and 1993, Canadian based hockey clubs won twenty-seven championships and not a single one over the last three plus decades.

From the 2008 Great Financial Crisis (G.F.C.) to now, the U.S. economy has only endured one mini-recession due to the Covid lockdowns. Yet I vividly remember the years between 1970 to 1982 when we endured four recessions. The economy spent four years, or one-third of the time in recession. That period was marked by high inflation and high unemployment. Yet economic growth over that period was higher than it is now. In Canada, a smaller percentage of the population went hungry than do today. Times change.

Different periods of economic history are unique. I believe that we are entering a new period that will be quite different from the 1982 to 2024 era. In fact, the period from 1982 to 2008 was a uniquely prosperous and stable period. Although we have not had a real recession after the G.F.C., we experienced low growth and unusually low interest rates. Government debt exploded. Our credit limit is running out and the lenders have raised our rates.

Interestingly, Trump frequently opines about the period after the Civil War to 1913, the year the Federal Reserve was established. Populists see the central bank as the cause of every economic problem America experienced in the last century. Many of them believe a secret cabal of bankers led by the Rothschilds and the Rockefellers laid the plans for the Russian Revolution, both world wars and anything bad that subsequently happened to anyone, anywhere and at anytime, for money and power. They never explain how their paranoia makes any logical sense.

If the delusions of the populists based on mass hysteria were in any way true, we should put up monuments to anyone involved in this, the “Great Fed Conspiracy.” Frankly, the wonderful period of economic utopia that Donald Trump has promised to bring back never happened the way the President thinks it did. Economic growth occurred but it was chaotic and much was the result of the population of the U.S. growing from 31.4 million in 1865 to over 100 million in 1915 and advancements in technology. The population of the U.S. grew two and a half times in only fifty years. This growth occurred despite the fact that in 1880, for example, over one-quarter of American children did not live to their fifth birthday.

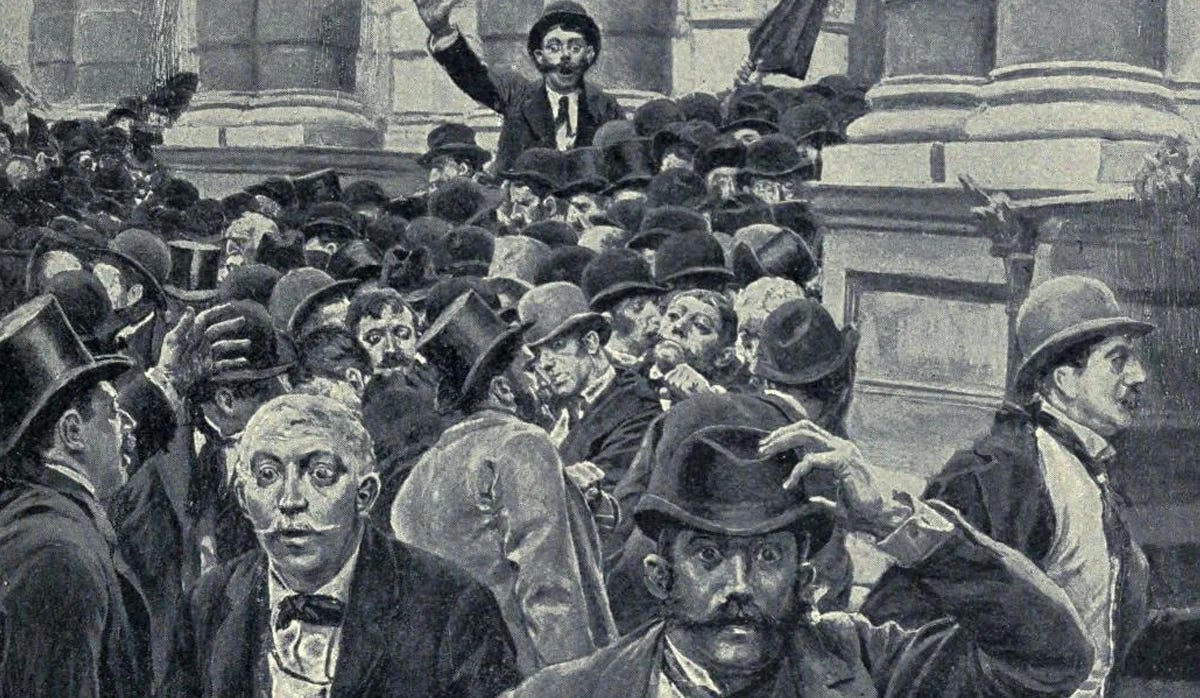

Trump’s golden age was marred by frequent and brutal recessions that were called panics and depressions. From the end of the Civil War to the founding of the Federal Reserve in 1913, there were twelve downturns. The Panic of 1873 was also known as the Long Depression because it lasted almost five and a half years. Unemployment rose to about 14%, according to some estimates. Business activity plunged between 25% and 33%. Deflation was a serious problem at times. Children died of starvation related medical maladies. Other “panics” may have been shorter during the post-Civil War period but they were as brutal in terms of the severity of the downturn. G.D.P. growth was high between those periods but that era was a nightmare for all too many common people. America and Europe turned to protectionism which only made matters worse. Trump’s hero President McKinley, eventually rejected tariffs. Trump’s analysis of the period seems to have been influenced less by economic history books and more by old Hollywood westerns and musicals.

The term recession also obfuscates economic reality. It is based on overall G.D.P., not average income per person. Canada has seen G.D.P. flatline due to huge levels of immigration. Average income, in real terms, has declined. Average income less housing costs and food prices has plummeted for many Canadians, especially those not benefiting from some form of government scheme. This is the first time in the memory of any living Canadian that so much of the population worried about affording food. Frankly, times were better during the worst part of any recession post World War II in Canada than now. Curiously, Americans have done much better but seem to complain more than Canadians.

Canada is not alone. the U.K. has also seen its standard of living decline for over a decade. This period of British decline began and coincided almost exactly with the tenure of current Canadian Prime Minister Mark Carney, as Governor of the Bank of England. A coincidence? Not likely. The same economic malfeasance and immigration folly that decimated the Canadian economy shattered Britain. Yet, Carney now leads the polls in the upcoming federal election proving that Canadians are easily manipulated and have not faced up to reality. Canadians hate Donald Trump so much that they are willing to destroy their own futures.

We are entering a new chapter in economic history categorized by deglobalization and slower overall economic growth thanks, in part, to a decline in the birth rate. This has resulted in an aging population and an increasing retiree to worker ratio. We are just beginning to experience the fallout of high government debt. Already high equity valuations will adjust to this new reality. My best guess is to expect low stock market returns over the long term relative to inflation and more frequent but mild recessions. This new era will be nowhere near as chaotic as the late 19th century but growth will be slow. Incomes will eventually rise due to labor shortages, but don’t hold your breath. This will take years, if not decades. Inflation will also rise as governments will pay back bondholders with currencies that constantly decrease in value. This is called “financial repression.” Get used to the term. You’re going to hear it a lot more in the future. Someone always has to pay for a debt restructuring.

Finally, here’s a fun fact about Trump’s “Golden Era”, between 1873 and 1921, the inflation adjusted price of the U.S. stock market index grew by an average annual return of 0%.